Agree: Common reporting standard bitcoin

| PROBABILITY OF MINING A BITCOIN BLOCK | 48 |

| Btcmt site | 384 |

| Common reporting standard bitcoin | 141 |

| Bitcoin private key 2018 | |

| Common reporting standard bitcoin |

OECD Weighs Crypto Tax Issues as it Stares Down Digital Economy

The OECD is assessing cryptocurrency and blockchain tax issues as it develops guidance on the digital economy as a whole, the organization’s top tax official told Bloomberg Tax Sept. 7.

Several countries, governments, and practitioners have flagged tax questions related to cryptocurrency and blockchain, the digital public ledger that records cryptocurrency transactions, said Pascal Saint-Amans, who heads the Organization for Economic Cooperation and Development’s Center for Tax Policy and Administration.

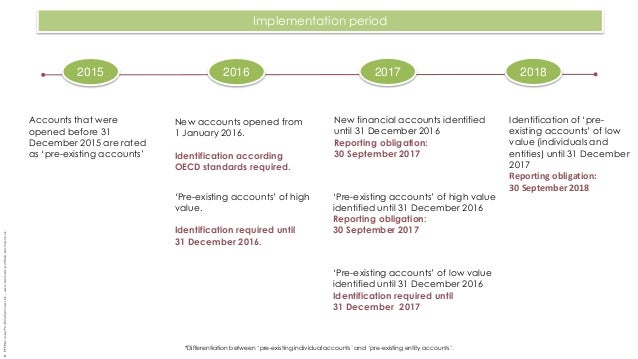

The Paris-based organization is in a “preliminary phase” of assessing those questions and will report to the international task force on the digital economy, set to meet in December, he said. That report will “more than likely” include either new guidance or a refinement to the OECD’s international system in which banks report financial account information to tax authorities and tax authorities exchange that information, he said.

The report may also call for a “refinement” of the Common Reporting Standard that underpins that system, he said.

The OECD official commented ahead of attending the the EU Economic and Financial Affairs Council meetings on Sept. 7 and Sept. 8 in Vienna. The group of finance ministers has taxation of the digital economy high on its agenda, he said.

Rewriting tax rules for the burgeoning digital economy is a top priority for the OECD and the European Union. The OECD in March released a report on the issue, flagging the accompanying hurdles. The report followed an EU proposal to levy a 3 percent tax on large digital companies.

French Report

A July 4 French report on cryptocurrency highlighted the need for updated tax and accounting regulations, to take into account initial coin offerings (ICOs). An ICO is when a company first issues cryptocurrency tokens.

The Group of 20 countries should commit to updating the CRS to take cryptocurrency and ICOs into account, the report said. Currently, the CRS only targets “traditional” banking and financial assets but “could be extended to crypto-assets exchanged on these platforms.”

The G-20 could require cryptocurrency platforms to collect identification numbers on their clients, similar to the “know-your-customer” requirements of the CRS.

Any tweaks to the CRS would likely be focused on ensuring financial information collected through the system “would not be lost through these types of technologies,” Saint-Amans said.

Money Laundering

The Center for Tax Policy and Administration is working with financial affairs officials at the OECD, and may also work with the Financial Action Task Force, an OECD-linked independent agency that targets money laundering and terrorist financing, he said.

The potential for cryptocurrency to be used to launder money is an issue the EU has previously flagged. The fifth revision of the EU Anti-Money Laundering Directive—passed May 14—defined virtual currency but has “blind spots” regarding money laundering and tax evasion, the European Parliament’s tax investigative committee said July 6.

Saint-Amans said the project is “in the diagnosis phase” so it’s too early to give any specifics about possible solutions.

“It’s one of the many things OECD is working on in relation to the digital economy. It’s extremely important. That’s why we’re doing it,” he said.

Solution Must Be ‘Global’

The OECD will report on digital economy to the task force in December. It will report to the G-20’s “inclusive framework” body for implementing recommendations from the base erosion and profit shifting (BEPS) reforms, Saint-Amans said.

The OECD is working on a “broader approach” to its digital economy proposal that would incorporate inter-group financing in general, Saint-Amans said. It’s also looking at EU proposals for a minimum tax and the idea of user contributions.

He didn’t elaborate on what he meant by “broader approach.”

Still, there’s no consensus for short-term measures to address the digital economy, Saint-Amans said. The EU’s proposed tax is meant to be a stop-gap solution until the bloc agrees on a permanent plan that would involve taxing companies’ virtual presences.

“What matters for us is that any long-term solution must be discussed at the global level, and I think there is consensus on that one,” he said.

0 thoughts on “Common reporting standard bitcoin”