Jp morgan invest in bitcoin - consider

JPMorgan Chase

| |

| |

| Type | Public |

|---|---|

| ISIN | US46625H1005 |

| Industry | Financial services |

| Predecessor | Chemical Bank J.P. Morgan & Co. The Manhattan Company Chase National Bank |

| Founded | December 1, 2000; 20 years ago (2000-12-01) |

| Founder | Balthazar P. Melick (Chemical Bank) John Pierpont Morgan (J.P. Morgan & Co.) Aaron Burr (The Manhattan Company) John Thompson (Chase National Bank) |

| Headquarters | , |

| Worldwide | |

| Jamie Dimon (Chairman & CEO) | |

| Products | Alternative financial services, American depositary receipts, asset allocation, asset management, bond trading, broker services, capital market services, collateralized debt obligations, commercial banking, commodities trading, credit cards, credit default swaps, credit derivative trading, currency exchange, custodian banking, debt settlement, digital banking, estate planning, exchange-traded funds, financial analysis, financial markets, foreign exchange market, futures exchange, hedge funds, index funds, information processing, institutional investing, insurance, investment banking, investment capital, investment management, investment portfolios, loan servicing, merchant services, mobile banking, money market trading, mortgage brokering, mortgage loans, mortgage–backed securities, mutual funds, pension funds, prime brokerage, private banking, private equity, remittance, retail banking, retail brokerage, risk management, securities lending, security services, stock trading, subprime lending, treasury services, trustee services, underwriting, venture capital, wealth management, wholesale funding, wholesale mortgage lending, wire transfers |

| Revenue |  US$115.627 billion (2019) US$115.627 billion (2019) |

US$44.545 billion (2019) US$44.545 billion (2019) | |

US$36.431 billion (2019) US$36.431 billion (2019) | |

| AUM |  US$2.988 trillion US$2.988 trillion |

| Total assets |  US$2.687 trillion (2019) US$2.687 trillion (2019) |

| Total equity |  US$261.330 billion (2019) US$261.330 billion (2019) |

256,981 (Q4 2019) 256,981 (Q4 2019) | |

| Divisions | Asset and Wealth Management, Consumer and Community Banking, Commercial Banking, Corporate and Investment Banking |

| Subsidiaries | Chase Bank J.P. Morgan & Co. One Equity Partners |

| Capital ratio | 15.8% (2019) |

| Footnotes / references [1][2][3] | |

JPMorgan Chase & Co. is an American multinationalinvestment bank and financial servicesholding company headquartered in New York City. JPMorgan Chase is ranked by S&P Global as the largest bank in the United States and the seventh largest bank in the world by total assets,[4] with total assets of US$3.213 trillion.[5] It is also the world's most valuable bank by market capitalization.[6] JPMorgan Chase is incorporated in Delaware.[7]

As a "Bulge Bracket" bank, it is a major provider of various investment banking and financial services. It is one of America's Big Four banks, along with Bank of America, Citigroup, and Wells Fargo.[8] JPMorgan Chase is considered to be a universal bank and a custodian bank. The J.P. Morgan brand, is used by the investment banking, asset management, private banking, private wealth management, and treasury services divisions. Fiduciary activity within private banking and private wealth management is done under the aegis of JPMorgan Chase Bank, N.A.—the actual trustee. The Chase brand is used for credit card services in the United States and Canada, the bank's retail banking activities in the United States, and commercial banking. Both the retail and commercial bank and the bank's corporate headquarters are currently located at 383 Madison Avenue in Midtown Manhattan, New York City, while the prior headquarters building directly across the street, 270 Park Avenue, is demolished and replaced with a new building.[9] The current company was originally known as Chemical Bank, which acquired Chase Manhattan and assumed that company's name. The present company was formed in 2000, when Chase Manhattan Corporation merged with J.P. Morgan & Co.[9] In October 2020 JPMorgan Chase declared that it begun to work on achieving carbon neutrality by 2050.[10]

As of 2020[update], the asset management arm of the bank has US$3.37 trillion in assets under management, while its investment and corporate bank arm holds US$27.447 trillion in assets under custody.[11] At US$45.0 billion in assets under management, the hedge fund unit of JPMorgan Chase is the third largest hedge fund in the world.[12]

History[edit]

JPMorgan Chase, in its current structure, is the result of the combination of several large U.S. banking companies since 1996, including Chase Manhattan Bank, J.P. Morgan & Co., Bank One, Bear Stearns and Washington Mutual. Going back further, its predecessors include major banking firms among which are Chemical Bank, Manufacturers Hanover, First Chicago Bank, National Bank of Detroit, Texas Commerce Bank, Providian Financial and Great Western Bank. The company's oldest predecessor institution, the Bank of the Manhattan Company, was the third oldest banking corporation in the United States, and the 31st oldest bank in the world, having been established on September 1, 1799, by Aaron Burr.

Chase Manhattan Bank[edit]

The Chase Manhattan Bank was formed upon the 1955 purchase of Chase National Bank (established in 1877) by the Bank of the Manhattan Company (established in 1799),[14] the company's oldest predecessor institution. The Bank of the Manhattan Company was the creation of Aaron Burr, who transformed The Manhattan Company from a water carrier into a bank.[15]

According to page 115 of An Empire of Wealth by John Steele Gordon, the origin of this strand of JPMorgan Chase's history runs as follows:

At the turn of the nineteenth century, obtaining a bank charter required an act of the state legislature. This of course injected a powerful element of politics into the process and invited what today would be called corruption but then was regarded as business as usual. Hamilton's political enemy—and eventual murderer—Aaron Burr was able to create a bank by sneaking a clause into a charter for a company, called the Manhattan Company, to provide clean water to New York City. The innocuous-looking clause allowed the company to invest surplus capital in any lawful enterprise. Within six months of the company's creation, and long before it had laid a single section of water pipe, the company opened a bank, the Bank of the Manhattan Company. Still in existence, it is today J. P. Morgan Chase, the largest bank in the United States.

Led by David Rockefeller during the 1970s and 1980s, Chase Manhattan emerged as one of the largest and most prestigious banking concerns, with leadership positions in syndicated lending, treasury and securities services, credit cards, mortgages, and retail financial services. Weakened by the real estate collapse in the early 1990s, it was acquired by Chemical Bank in 1996, retaining the Chase name.[16][17] Before its merger with J.P. Morgan & Co., the new Chase expanded the investment and asset management groups through two acquisitions. In 1999, it acquired San Francisco-based Hambrecht & Quist for $1.35 billion.[18] In April 2000, UK-based Robert Fleming & Co. was purchased by the new Chase Manhattan Bank for $7.7 billion.[19]

Chemical Banking Corporation[edit]

The New York Chemical Manufacturing Company was founded in 1823 as a maker of various chemicals. In 1824, the company amended its charter to perform banking activities and created the Chemical Bank of New York. After 1851, the bank was separated from its parent and grew organically and through a series of mergers, most notably with Corn Exchange Bank in 1954, Texas Commerce Bank (a large bank in Texas) in 1986, and Manufacturer's Hanover Trust Company in 1991 (the first major bank merger "among equals"). In the 1980s and early 1990s, Chemical emerged as one of the leaders in the financing of leveraged buyout transactions. In 1984, Chemical launched Chemical Venture Partners to invest in private equity transactions alongside various financial sponsors. By the late 1980s, Chemical developed its reputation for financing buyouts, building a syndicated leveraged finance business and related advisory businesses under the auspices of the pioneering investment banker, Jimmy Lee.[20][21] At many points throughout this history, Chemical Bank was the largest bank in the United States (either in terms of assets or deposit market share).

In 1996, Chemical Bank acquired Chase Manhattan. Although Chemical was the nominal survivor, it took the better-known Chase name.[16][17] To this day, JPMorgan Chase retains Chemical's pre-1996 stock price history, as well as Chemical's former headquarters site at 270 Park Avenue (with the current building being demolished for a replacement headquarters on the same site).

J.P. Morgan & Company[edit]

The House of Morgan was born out of the partnership of Drexel, Morgan & Co., which in 1895 was renamed J.P. Morgan & Co. (see also: J. Pierpont Morgan).[22] J.P. Morgan & Co. financed the formation of the United States Steel Corporation, which took over the business of Andrew Carnegie and others and was the world's first billion dollar corporation.[23] In 1895, J.P. Morgan & Co. supplied the United States government with $62 million in gold to float a bond issue and restore the treasury surplus of $100 million.[24] In 1892, the company began to finance the New York, New Haven and Hartford Railroad and led it through a series of acquisitions that made it the dominant railroad transporter in New England.[25]

Built in 1914, 23 Wall Street was the bank's headquarters for decades. On September 16, 1920, a terrorist bomb exploded in front of the bank, injuring 400 and killing 38.[26] Shortly before the bomb went off, a warning note was placed in a mailbox at the corner of Cedar Street and Broadway. The case has never been solved, and was rendered inactive by the FBI in 1940.[27]

In August 1914, Henry P. Davison, a Morgan partner, made a deal with the Bank of England to make J.P. Morgan & Co. the monopoly underwriter of war bonds for the UK and France. The Bank of England became a "fiscal agent" of J.P. Morgan & Co., and vice versa.[28] The company also invested in the suppliers of war equipment to Britain and France. The company profited from the financing and purchasing activities of the two European governments.[28]

In the 1930s, J.P. Morgan & Co. and all integrated banking businesses in the United States were required by the provisions of the Glass–Steagall Act to separate their investment banking from their commercial banking operations. J.P. Morgan & Co. chose to operate as a commercial bank.[29][better source needed]

In 1935, after being barred from the securities business for over a year, the heads of J.P. Morgan spun off its investment-banking operations. Led by J.P. Morgan partners, Henry S. Morgan (son of Jack Morgan and grandson of J. Pierpont Morgan) and Harold Stanley, Morgan Stanley was founded on September 16, 1935, with $6.6 million of nonvoting preferred stock from J.P. Morgan partners.[29][better source needed] In order to bolster its position, in 1959, J.P. Morgan merged with the Guaranty Trust Company of New York to form the Morgan Guaranty Trust Company.[22] The bank would continue to operate as Morgan Guaranty Trust until the 1980s, before migrating back to the use of the J.P. Morgan brand. In 1984, the group purchased the Purdue National Corporation of Lafayette Indiana. In 1988, the company once again began operating exclusively as J.P. Morgan & Co.[30]

Bank One Corporation[edit]

In 2004, JPMorgan Chase merged with Chicago-based Bank One Corp., bringing on board current Chairman and CEO Jamie Dimon as president and COO.[31] He succeeded former CEO William B. Harrison, Jr.[32] Dimon introduced new cost-cutting strategies, and replaced former JPMorgan Chase executives in key positions with Bank One executives—many of whom were with Dimon at Citigroup. Dimon became CEO in December 2005 and Chairman in December 2006.[33]

Bank One Corporation was formed with the 1998 merger of Banc One of Columbus, Ohio and First Chicago NBD.[34] This merger was considered a failure until Dimon took over and reformed the new firm's practices. Dimon effected changes to make Bank One Corporation a viable merger partner for JPMorgan Chase.[35]

Bank One Corporation, formerly First Bancgroup of Ohio, was founded as a holding company for City National Bank of Columbus, Ohio, and several other banks in that state, all of which were renamed "Bank One" when the holding company was renamed Banc One Corporation.[36] With the beginning of interstate banking they spread into other states, always renaming acquired banks "Bank One." After the First Chicago NBD merger, adverse financial results led to the departure of CEO John B. McCoy, whose father and grandfather had headed Banc One and predecessors. JPMorgan Chase completed the acquisition of Bank One in the third quarter of 2004.[36]

Bear Stearns[edit]

At the end of 2007, Bear Stearns was the fifth largest investment bank in the United States but its market capitalization had deteriorated through the second half of the year.[37] On Friday, March 14, 2008, Bear Stearns lost 47% of its equity market value as rumors emerged that clients were withdrawing capital from the bank. Over the following weekend, it emerged that Bear Stearns might prove insolvent, and on March 15, 2008, the Federal Reserve engineered a deal to prevent a wider systemic crisis from the collapse of Bear Stearns.[38]

On March 16, 2008, after a weekend of intense negotiations between JPMorgan, Bear, and the federal government, JPMorgan Chase announced its plans to acquire Bear Stearns in a stock swap worth $2.00 per share or $240 million pending shareholder approval scheduled within 90 days.[38] In the interim, JPMorgan Chase agreed to guarantee all Bear Stearns trades and business process flows.[39] On March 18, 2008, JPMorgan Chase formally announced the acquisition of Bear Stearns for $236 million.[37] The stock swap agreement was signed that night.[40]

On March 24, 2008, after public discontent over the low acquisition price threatened the deal's closure, a revised offer was announced at approximately $10 per share.[37] Under the revised terms, JPMorgan also immediately acquired a 39.5% stake in Bear Stearns using newly issued shares at the new offer price and gained a commitment from the board, representing another 10% of the share capital, that its members would vote in favor of the new deal. With sufficient commitments to ensure a successful shareholder vote, the merger was completed on May 30, 2008.[41]

Washington Mutual[edit]

On September 25, 2008, JPMorgan Chase bought most of the banking operations of Washington Mutual from the receivership of the Federal Deposit Insurance Corporation. That night, the Office of Thrift Supervision, in what was by far the largest bank failure in American history, had seized Washington Mutual Bank and placed it into receivership. The FDIC sold the bank's assets, secured debt obligations, and deposits to JPMorgan Chase & Co for $1.836 billion, which re-opened the bank the following day. As a result of the takeover, Washington Mutual shareholders lost all their equity.[42]

JPMorgan Chase raised $10 billion in a stock sale to cover writedowns and losses after taking on deposits and branches of Washington Mutual.[43] Through the acquisition, JPMorgan now owns the former accounts of Providian Financial, a credit card issuer WaMu acquired in 2005. The company announced plans to complete the rebranding of Washington Mutual branches to Chase by late 2009.

Chief executive Alan H. Fishman received a $7.5 million sign-on bonus and cash severance of $11.6 million after being CEO for 17 days.[44]

2013 settlement[edit]

On November 19, 2013, the Justice Department announced that JPMorgan Chase agreed to pay $13 billion to settle investigations into its business practices pertaining to mortgage-backed securities.[45] Of that amount, $9 billion was penalties and fines, and the remaining $4 billion was consumer relief. This was the largest corporate settlement to date. Conduct at Bear Stearns and Washington Mutual prior to their 2008 acquisitions accounted for much of the alleged wrongdoing. The agreement did not settle criminal charges.[46]

Other recent acquisitions[edit]

In 2006, JPMorgan Chase purchased Collegiate Funding Services, a portfolio company of private equity firm Lightyear Capital, for $663 million. CFS was used as the foundation for the Chase Student Loans, previously known as Chase Education Finance.[47]

In April 2006, JPMorgan Chase acquired Bank of New York Mellon's retail and small business banking network. The acquisition gave Chase access to 339 additional branches in New York, New Jersey, and Connecticut.[48]

In March 2008, JPMorgan acquired the UK-based carbon offsetting company ClimateCare.[49]

In November 2009, JPMorgan announced it would acquire the balance of JPMorgan Cazenove, an advisory and underwriting joint venture established in 2004 with the Cazenove Group, for GBP1 billion.[50]

In January 2013, JPMorgan acquired Bloomspot, a San Francisco-based startup in the "deals" space for $35 million. Shortly after the acquisition, the service was shut down and Bloomspot's talent was left unused.[51][52]

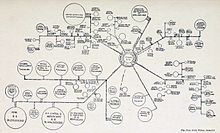

Acquisition history[edit]

The following is an illustration of the company's major mergers and acquisitions and historical predecessors, although this is not a comprehensive list:

Recent history[edit]

In October 2014, JPMorgan sold its commodities trader unit to Mercuria for $800 million, a quarter of the initial valuation of $3.5 billion, as the transaction excluded some oil and metal stockpiles and other assets.[62]

In March 2016, JPMorgan decided not to finance coal mines and coal power plants in wealthy countries.[63] In September 2016, JPMorgan made an equity investment in InvestCloud.[64] In December 2016, 14 former executives of the Wendel investment company faced trial for tax fraud while JP Morgan Chase was to be pursued for complicity. Jean-Bernard Lafonta was convicted December 2015 for spreading false information and insider trading, and fined 1.5 million euros.[65]

In March 2017, Lawrence Obracanik, a former JPMorgan Chase & Co employee, pleaded guilty to criminal charges that he stole more than $5 million from his employer to pay personal debts.[66] In June 2017, Matt Zames, the now-former COO of the bank decided to leave the firm.[67] In December 2017, JP Morgan was sued by the Nigerian government for $875 million, which Nigeria alleges was transferred by JP Morgan to a corrupt former minister.[68] Nigeria accused JP Morgan of being "grossly negligent".[69]

In October 2018, Reuters reported that JP Morgan "agreed to pay $5.3 million to settle allegations it violated Cuban Assets Control Regulations, Iranian sanctions and Weapons of Mass Destruction sanctions 87 times, the U.S. Treasury said".[70]

In February 2019, JP Morgan announced the launch of JPM Coin, a digital token that will be used to settle transactions between clients of its wholesale payments business.[71] It would be the first cryptocurrency issued by a United States bank.[72]

In September 2020, the company admitted that it manipulated precious metals futures and government bond markets in a span period of eight years. It settled with the United States Department of Justice, U.S. Securities and Exchange Commission, and the Commodity Futures Trading Commission for $920 million. JPMorgan will not face criminal charges, however, it will launch into a deferred prosecution agreement for three years.[73]

Financial data[edit]

| Year | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 25.87 | 31.15 | 33.19 | 29.34 | 29.61 | 33.19 | 42.74 | 54.25 | 62.00 | 71.37 | 67.25 | 100.4 | 102.7 | 97.23 | 97.03 | 96.61 | 94.21 | 93.54 | 95.67 | 99.62 | 109.03 |

| Net income | 4.745 | 7.501 | 5.727 | 1.694 | 1.663 | 6.719 | 4.466 | 8.483 | 14.44 | 15.37 | 5.605 | 11.73 | 17.37 | 18.98 | 21.28 | 17.92 | 21.76 | 24.44 | 24.73 | 24.44 | 32.47 |

| Assets | 626.9 | 667.0 | 715.3 | 693.6 | 758.8 | 770.9 | 1,157 | 1,199 | 1,352 | 1,562 | 2,175 | 2,032 | 2,118 | 2,266 | 2,359 | 2,416 | 2,573 | 2,352 | 2,491 | 2,534 | 2,623 |

| Equity | 35.10 | 35.06 | 42.34 | 41.10 | 42.31 | 46.15 | 105.7 | 107.2 | 115.8 | 123.2 | 166.9 | 165.4 | 176.1 | 183.6 | 204.1 | 210.9 | 231.7 | 247.6 | 254.2 | 255.7 | 256.5 |

| Capitalization | 75.03 | 138.7 | 138.4 | 167.2 | 147.0 | 117.7 | 164.3 | 165.9 | 125.4 | 167.3 | 219.7 | 232.5 | 241.9 | 307.3 | 366.3 | 319.8 | |||||

| Headcount(in thousands) | 96.37 | 161.0 | 168.8 | 174.4 | 180.7 | 225.0 | 222.3 | 239.8 | 260.2 | 259.0 | 251.2 | 241.4 | 234.6 | 243.4 | 252.5 | 256.1 |

Note. For years 1998, 1999, and 2000 figures are combined for The Chase Manhattan Corporation and J.P.Morgan & Co. Incorporated as if a merger between them already happened.

JPMorgan Chase[81] was the biggest bank at the end of 2008 as an individual bank (not including subsidiaries). As of 2020[update], JPMorgan Chase is ranked 17 on the Fortune 500 rankings of the largest United States corporations by total revenue.[82]

CEO-to-worker pay ratio[edit]

For the first time in 2018, a new Securities and Exchange Commission rule mandated under the 2010 Dodd-Frank financial reform requires publicly traded companies to disclose how their CEOs are compensated in comparison with their employees. In public filings, companies have to disclose their "Pay Ratios," or the CEO's compensation divided by the median employee's.[83]

2017[edit]

According to SEC filings, JPMorgan Chase & Co. paid its CEO $28,320,175 in 2017. The average worker employed by JPMorgan Chase & Co. was paid $77,799 in 2017; thus marking a CEO-to-worker Pay Ratio of 364 to 1.[84] As of April 2018, steelmaker Nucor represented the median CEO-to-worker Pay Ratio from SEC filings with values of 133 to 1.[85]Bloomberg BusinessWeek on May 2, 2013 found the ratio of CEO pay to the typical worker rose from about 20-to-1 in the 1950s to 120-to-1 in 2000.[86]

2018[edit]

Total 2018 compensation for Jamie Dimon, CEO, was $30,040,153, and total compensation of the median employee was determined to be $78,923. The resulting pay ratio was estimated to be 381:1.[87]

Structure[edit]

J P Morgan Chase & Co. owns 5 bank subsidiaries in the United States:[88]

For management reporting purposes, J P Morgan Chase's activities are organized into a corporate/ private equity segment and 4 business segments:

- Consumer and community banking,

- Corporate and investment banking,

- Commercial banking and

- Asset management.[89]

The investment banking division at J P Morgan is divided by teams:

- Industry,

- Mergers & Acquisitions and

- Capital markets.

Industry teams include:

- Consumer and retail,

- Healthcare,

- Diversified industries and transportation,

- Natural resources,

- Financial institutions,

- Metals and mining,

- Real estate and technology,

- Media and

- Telecommunications.

JPMorgan Europe, Ltd.[edit]

The company, known previously as Chase Manhattan International Limited, was founded on September 18, 1968.[90][91]

In August 2008, the bank announced plans to construct a new European headquarters at Canary Wharf, London.[92] These plans were subsequently suspended in December 2010, when the bank announced the purchase of a nearby existing office tower at 25 Bank Street for use as the European headquarters of its investment bank.[93] 25 Bank Street had originally been designated as the European headquarters of Enron and was subsequently used as the headquarters of Lehman Brothers International (Europe).

The regional office is in London with offices in Bournemouth, Glasgow, and Edinburgh for asset management, private banking, and investment.[94]

Senior leadership[edit]

List of former chairmen[edit]

- William B. Harrison Jr. (2000–2006)[96]

List of former chief executives[edit]

- William B. Harrison Jr. (2000–2005)[96]

Operations[edit]

Earlier in 2011, the company announced that by the use of supercomputers, the time taken to assess risk had been greatly reduced, from arriving at a conclusion within hours to what is now minutes. The banking corporation uses for this calculation Field-Programmable Gate Array technology.[97]

-

-